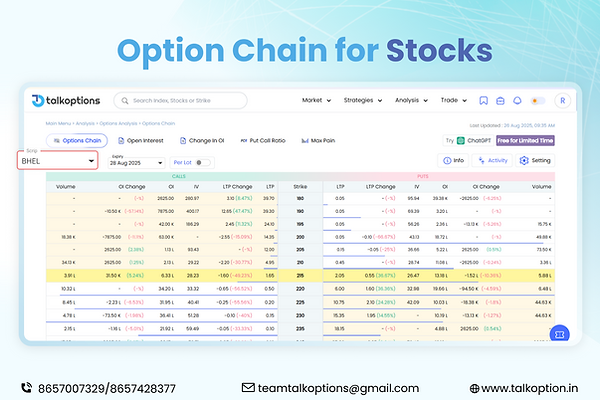

Option Chain for Stocks | NSE Option Chain Stock List with Price | Best Option Chain Stocks Analysis | Open Free Account Online and Start Trading Today !

Explore the benefits of an option chain for stocks with Talkoptions. Check the NSE option chain stock list, learn to analyse them, and track the best stock for trading. Get the real-time market insights for all the stocks, Nifty, and Bank Nifty with Talkoptions ' advanced tool, one of your best choices for accuracy and speed.

Option Chain for Stocks – A Complete Guide

In today's financial world, understanding the option chain for a stock is the first step towards success. The NSE option chain stock list provides deep insights about the market sentiment, various strike prices, premium prices, and much more. These details help traders to make informed trading decisions. Whether you are trading Nifty, Bank Nifty, or any other stock's option chain for stocks is your beginning point. Let us explore more about the same in this article.

What is an Option Chain for Stocks ?

An option chain for stocks is a well-organised table that shows all the available call and put option contracts for stocks and indexes. This table includes data such as strike prices, expiration dates, premium prices, volume, and open interest. Traders gain all the information at a glance with clear pricing. It helps investors and traders to compare between various strike prices and find the best trading opportunities. By analysing the NSE option chain stock list with price, traders gain insights about the positioning in the market, future expectations for Nifty, or any other NSE-listed stock.

Let us also explain the key elements individually that are found on the option chain for stocks.

-

Underlying asset is the specific stocks, index, or ETFs on which the contracts are based.

-

Expiry dates are the date on which the contracts expire; these are generally listed chronologically.

-

Strike price - it is the price at which the option contracts are bought or sold.

-

Bid-ask price is the market price for each option contract, the bid being the highest buyer offer, and the ask is the lowest seller offer.

-

Volume shows the number of contracts traded on a specific trading day, while the open interest shows the contracts still pending for settlement.

-

Apart from the above information, traders can also find the details such as option Greeks, LTP (last traded price)

How to Use the Option Chain to Analyse Stocks ?

The option chain for stocks works like the X-ray of the market. It reveals where the traders are placing their highest bets, on call options or put options.

For example, if the OI (open interest) value of call options is high at some strike price, it suggests a strong resistance at that level. On the contrary, if there is high open interest in put options, it signals a support level.

With the help of an option chain stock list with price, traders can track all the changes happening in real-time. The real-time analysis also helps in identifying the best option chain stocks NSE for short-term and long-term trades, further elaborating it to identify high demand zones, and making the analysis sharper and data-driven.

What are the Steps to Analyse Particular Stocks in the Option Chain ?

Follow the step-wise procedure below to analyse the specific stock through the option chain for stocks matrix.

-

Choose a reputable online trading platform that also supports option trading and allows access to option chains.

-

Using the built-in filters, select your desired stock from the desired industry.

-

Navigate to the option chain for stocks or option matrix; different platforms might have different interfaces.

-

Review the NSE option chain stock list with price to analyse the current market situation for calls and put options.

-

Analyse the open interest, volume, Greeks, etc, to understand the sentiment.

-

Compare the various strike prices to identify the key support and resistance levels at a glance.

-

Based on all the above analysis, shortlist the ones you would like to trade with.

-

Choose the expiry from the options such as weekly, monthly, quarterly, or even yearly, as per your trading frequency.

-

Note - Refer to the option chain share list to validate your research before entering into the trades.

How to Use Option Chain Data to Predict Stock Price ?

One of the main benefits of an option chain for stocks is its ability to predict the stock based on various factors. For example, if put contracts are dominating the market, it signals strong support. In a similar way, there are various ways to predict the stock price by selecting particular stock from NSE option chain stock list. Let's understand them further :

-

By gauging the market sentiment, traders can predict the stock price, such as when there is high open interest at a certain strike price, it indicates either strong support or strong resistance.

-

By accessing the liquidity also, traders can also predict the stock price. Identify the strike with the high volume and open interest for better liquidity.

-

Monitor the change in the premium prices, volume traded, and open interest, and understand the market activity.

Why Choose Talkoptions Option Chain to Analyse Stock or Index ?

The answer to why choose Talkoptions is - it offers the most advanced platforms for stock analysis. This option chain for stocks analysis tool offers an option chain share list in a user-friendly manner, which is easy to read for both beginner and experienced traders. Traders can quickly explore the NSE option chain stock list with price, view live open interest, and identify the best opportunities. Talkoptions ensures high speed, accuracy, and the best interface. By selecting the Talkoptions, you are gaining access to the real-time market data for all NSE-listed stocks and indices.

How Option Chain Analysis Helps Traders ?

-

It helps in identifying the key support and resistance levels by highlighting the strike prices with Open interest, which act as key support and resistance zones.

-

An option chain for stocks helps in forecasting the trend reversals by observing the changes in call and put OI values.

-

The NSE option chain stock list helps traders identify and focus on the most active and liquid stocks for profitable trading opportunities.

-

An option chain stock with price also assists in gauging the near-term market direction for Nifty or any individual stocks.

-

It also shows the institutional activity and helps to know where the smart money moves.

-

Helps in strategy optimization, such as buying, selling, hedging, or adjusting the position to align with the market signals.

-

With the clear data about the market, traders can reduce the overall risk and increase their chances of profitability effectively.

Conclusion

The option chain for stocks is an important tool for traders who need to understand the market sentiment, identify crucial levels, and trade with confidence in this volatility. By analysing the NSE option chain stock list from Talkoptions, traders can identify the best opportunity and make informed decisions related to any stock, Nifty, or Bank Nifty. If you have not yet explored the Talkoptions advanced option chain tools, check them out today and register, as it is FREE!