Long Put Option Strategy

- Kajal Deshmukh

- Jun 28, 2023

- 6 min read

A long-put options strategy is a single-legged strategy. It is a bearish strategy, and risk is predefined. Traders buy put options as an alternative to short-selling the stock. The short selling of the stock is not available for all the traders, as it includes margin. Further, in short-selling, the stock trader has unlimited risk, as there is unlimited upside potential. Thus, entering into the long put is a better idea.

Long put options contracts provide the right to sell the shares of the underlying stock but are not obliged to do so at its strike price on or before the expiry date of the contract as the option contracts are levered type investments. Every contract has 100 shares of that stock. The advantage the traders get to enter into the contract is that they are less costly compared to selling 100 shares of the stock, but the disadvantage is the risk of losing the cost to enter the options contract.

Long Put options contract from the market's perspective:

When the traders believe that price of the underlying asset will at least decline by the cost of the premium on or before the contract expiry, they enter into the long-put strategy. The contracts with far out-of-the-money strike prices will be less expensive, but the possibility of their success is also low. The further the contract's strike price, the more bearish the underlying asset will become.

How can I set up a Long-Put options strategy?

All the details of the put options are available in the option chain. Traders assess various data such as bid-ask price, strike price, time to expire, etc., and after carefully evaluating them, buy a Put contract. The amount the traders pay to enter the trade or to buy the option contract is called the premium. Many factors are considered while deciding to buy the put options, apart from the ones mentioned above such as; rate of volatility, strike price, premium prices, and time remaining in expiring that contract.

Generally, the put options are more expensive than their opposite long-call options. The long-put options are purchased because the traders are willing to pay the high premium to protect their investment against the downside risk by hedging the position.

Understanding the diagram of the Long Put options:

The diagram of the Long-put options is very simple to understand. The highest risk to the trader is equal to the amount paid to enter the trade, in simple terms, the premium.

The potential to profit is unlimited in the downward direction until the asset reaches Rs. 0. To reach a break-even point during expiry, the stock price must be below the cost paid to enter the long-put option contract.

For example: suppose the traders have bought the long-put options contract worth Rs.100 by paying Rs. 5 as the premium amount. In this scenario, the highest loss to the trader will be Rs. 500, and the profit potential is unlimited until the stock reaches Rs. 0. But the stock must close below Rs. 95 to profit. (Rs.100 stock price -Rs. 5 premium paid).

How can I enter the long-put options contract?

A buy-to-open order is sent to the trader to enter the long-put position. Traders can fill the asking price, market order, or some other price they are willing to spend to protect their fund, known as a limit order. When they buy the call at any price, that amount gets debited from their trading account.

• Buy-to-open: Rs. 100 Put options contract.

How can I exit a Long-put option contract?

Traders have many ways to exit from the long-put options strategy. They should exit

the trader before the contracts expire. To exit, traders need to order sell-to-close (STC),

and contracts can be sold at the market price or the limit price. The premium received

by selling the contracts will get credited to the trader's account.

When the contract's selling price is higher than the original premium paid, traders will profit. On the contrary, if they are sold at a lower price than the initial payment, traders will lose.

Suppose the long-put options are in-the-money at the time of expiry, then the contract holder may execute the trade and sell the 100 shares of the underlying stock at the strike price. Now, if the long-put options are out-of-the-money (OTM) at the time of expiry, the contract will expire worthlessly, and traders will have a huge loss.

The impact of the time decay factor on the long-put strategy:

The time left in the expiry of the contract and the implied volatility together result in

the extrinsic value, which impacts the premium's cost. Keeping all other factors the

same, the time remaining to expire will lead to high prices, as the stock has enough

time for any price movements. As the expiry time approaches, the contracts lose their

value, and hence we can say that the time decay pr theta factor does not favor the

long-put strategy and works against the option buyers.

The impact of the Implied volatility on the long-put strategy:

The implied volatility represents the probability of the price fluctuation of the underlying stock in the future. High implied volatility means higher price options as traders expect the price to move beyond their expectations. With the decline in the volatility rate, the price of the options also declines. The options buyers benefit if there is high implied volatility prior to their expiry.

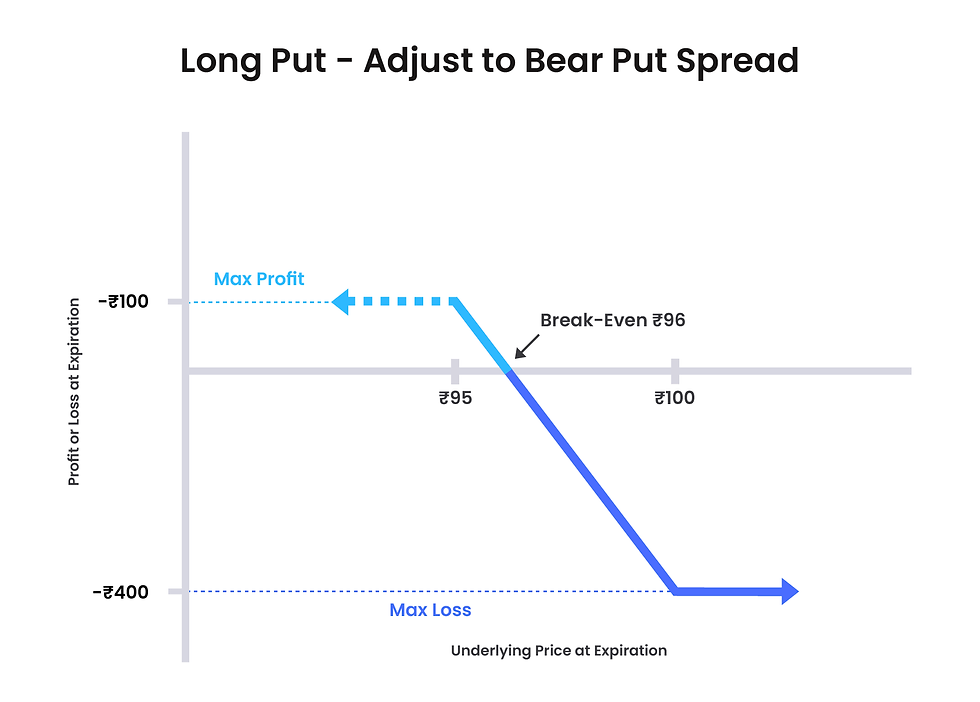

How can I adjust the long-put strategy?

Traders can adjust the long-put options to minimize the potential loss by converting

the single-legged put options into a bear put debit spread.

For example: Suppose a trader has bought the put option of Rs. 100 by paying a premium of Rs. 5, he might sell the put option at Rs. 95. In short-selling the put options, a trader has received the credit of Rs. 1, which will reduce the total loss to Rs. -400. The highest profit is limited to Rs. 100. The new break-even point is Rs.1 less than the previous diagram.

• Sell-to-open: Rs. 95 put options contract.

How can I roll the long-put strategy?

Traders can roll the position to extend the time duration of the trade if the price has not decreased before expiry. The rolling facility offers more time in the future, allowing the trade to become profitable, but at the same time, traders have to pay extra to roll the position, as the more time the contracts have in expiring will lead to high options prices.

Suppose the trader wants to roll the strategy and wants to extend the duration of the

trade, in this case, a trader can order sell-to-close on the existing long put and buy to-open (BTO) a new put option with a future expiry date. By doing so, traders will incur some additional cost on the initial position.

For example: a trader has a put option of Rs. 100 expiring in June, a trader can sell this and buy a new put option at Rs.100, expiring in July. Suppose the initial contract had cost the trader Rs. 5 as a premium and by short selling, he received Rs. 2 credit, then the trader will have a net loss of Rs. -300 per contract. Now, if the new July contract costs the trader Rs. 5 extra, the total debit paid will be Rs. 8, which has increased the potential loss to Rs. -800, and the new break-even point is now at Rs. 92.

How can I hedge a long-put option?

Traders can hedge long put options by buying call options having the same strike

price and expiry date; this will create a long straddle. If the price rises above the strike

price, then the call option will receive a benefit, which will help offset the risk of the long-put option. But this will add the extra cost to the initial trade and will also broaden the break-even price.

For example: suppose the initial or original long put had a debit of Rs. 5, and the trader paid an extra Rs. 5 to buy the call option; by doing so, the total potential risk increased to Rs. 1000, and the new break-even points were also extended.

• But-to-open: Rs 100 call options contract.

Synthetic Long put:

A synthetic long put is created when a trader combines the short stock and a long option with the strike price of the original short stock position. The diagram of the synthetic long put is similar to the single long put option. In this scenario, the highest loss will be limited to the strike price of the long option, while the maximum profit potential will be limited to the difference between the short stock selling price and the premium paid for the call option.

So, this was all about the long-put option strategy in the options market. These types of single-legged strategies are best for those who have recently joined the options world and are still practicing. After getting enough confidence and knowledge, they may try multiple leg strategies and make more money. We hope you are satisfied with the information provided on this page; if you have any questions, you may contact our options expert team at the number provided.